Credit and Debit Cards

Introduction

Credit and debit cards are among the most widely used payment methods globally, providing customers with a secure and convenient way to complete transactions. While both payment options involve cards issued by financial institutions, the key difference lies in how payments are processed.

Credit cards allow customers to borrow funds from their card issuer to complete a transaction, ensuring merchants receive the payment even if the customer's account lacks sufficient funds at the time. This adds a layer of financial security for merchants, as the issuer guarantees the transaction.

In contrast, debit cards are directly linked to the customer's bank account, and payments are deducted immediately upon transaction approval. This means merchants rely on the availability of funds in the customer's account when processing debit card transactions.

By supporting both options, SmartPay enables merchants to cater to a wide range of customer preferences and payment needs. SmartPay supports major card brands such as Visa, Mastercard, American Express, JCB, and Carte Bancaire for both credit and debit cards. These payment methods are compatible with one-time purchases, recurring payments, and subscriptions, offering flexibility for both customers and merchants.

Workflows and Transaction Types

SmartPay Integration Flow for Merchants

Merchants integrating credit or debit cards with SmartPay should follow these steps:

-

Integration Prerequisites: Prepare the testing and production environments and obtain the necessary API credentials.

-

Create Checkout API: Use the Create Checkout API to initiate card payment sessions, securely collect cardholder information, and process payments.

-

Payment Form SDK: Implement the Payment Form SDK to securely collect and tokenize card details. This ensures sensitive card data is never exposed to merchants, enhancing security.

-

Network Tokens: Enable network tokenization to enhance security by replacing card details with tokens, which can be safely stored and reused for future transactions.

Customer-Initiated Transactions (CIT)

- Guest Payments: Customers can make one-time payments without saving their card details.

- Registered Users: Customers can securely store their card information for faster future transactions.

Merchant-Initiated Transactions (MIT)

- Subscriptions: Merchants can set up recurring payments for subscription-based services, with automated billing at specified intervals.

- Stored Payment Options (SPO): Securely stored card details can be used for seamless future transactions, ensuring customer convenience.

Transaction Status Flow

Merchants should implement SmartPay notifications to receive transaction status updates. Upon receiving a notification, merchants must call the Get Payment Status API to verify the transaction status.

Credit and Debit Card test Data

Test data is provided to support simulation of payment flows across all available payment options during integration and testing. It facilitates validation of API behavior, verification of SDK rendering, and end-to-end troubleshooting without processing real transactions.

Please note, that these cards are solely intended for testing purposes. Do not use them outside of test systems!

As of the new Payment Services Directive (PSD2) currently we only accept Card Payments with 3D Secure Enabled Credit/Debit Cards.

When configuring Content Security Policy consider 3-D Secure Verification will redirect to the Customer's Issuing Bank in order to Authorize the Transaction.

For Carte Bancaire (in France), please use any valid VISA test card. This is for testing purposes only!

ACI test credit cards

| VISA | Mastercard | American Express | JCB | Payment | Registration |

|---|---|---|---|---|---|

| 4200 0000 0000 0042 | 5200 0000 0000 0015 | 3434 3434 3434 343 | 3566 0023 4543 2153 | Challenge | Challenge |

| 4200 0000 0000 0067 | 5200 0000 0000 0049 | 3759 8700 0000 021 | 3569 9900 1009 5916 | Challenge | Challenge |

| 4200 0000 0000 0018 | 5200 0000 0000 0064 | 3759 8700 0169 867 | 3569 9900 1230 0876 | Challenge | Challenge |

| 4200 0000 0000 0075 | 5200 0000 0000 0072 | 3714 4963 5398 431 | 3569 9900 1230 0884 | Challenge | Challenge |

| 4200 0000 0000 0091 | 5200 0000 0000 0007 | 3745 0026 2001 008 | 3530 1113 3330 0000 | Frictionless | Challenge |

| 4200 0000 0000 0109 | 5200 0000 0000 0023 | 3772 7708 1382 243 | 3566 0020 2036 0505 | Frictionless | Challenge |

| 4200 0000 0000 0026 | 5200 0000 0000 0056 | 3759 8700 0000 062 | 3569 9900 1227 8361 | Frictionless | Challenge |

| 4200 0000 0000 0059 | 5200 0000 0000 0106 | 3739 5319 2351 004 | 3569 9900 1227 8353 | Frictionless | Challenge |

During Registrations (Adding a Stored Payment Option) of Credit / Debit Cards, the 3-D Secure Verification "Challenge" Flow is Mandatory to Enhance Security.

To test a Failure scenario select "Technical Error" from the 3-D Secure Simulator.

Additional Card Details

| Item | Description | Example |

|---|---|---|

| Expiry Date | Any valid Date in the future | ex. for February 2025 enter "02/25" |

| Card Holder | Any Name can be provided | ex. "John Doe" or "Hans Gruber" |

| CVV / CVC | VISA / Mastercard - 3 Digits American Express - 4 Digits | ex. "123", "505" or "999" etc. ex. "1234", "9999" and so on |

3-D Secure Verification Simulators

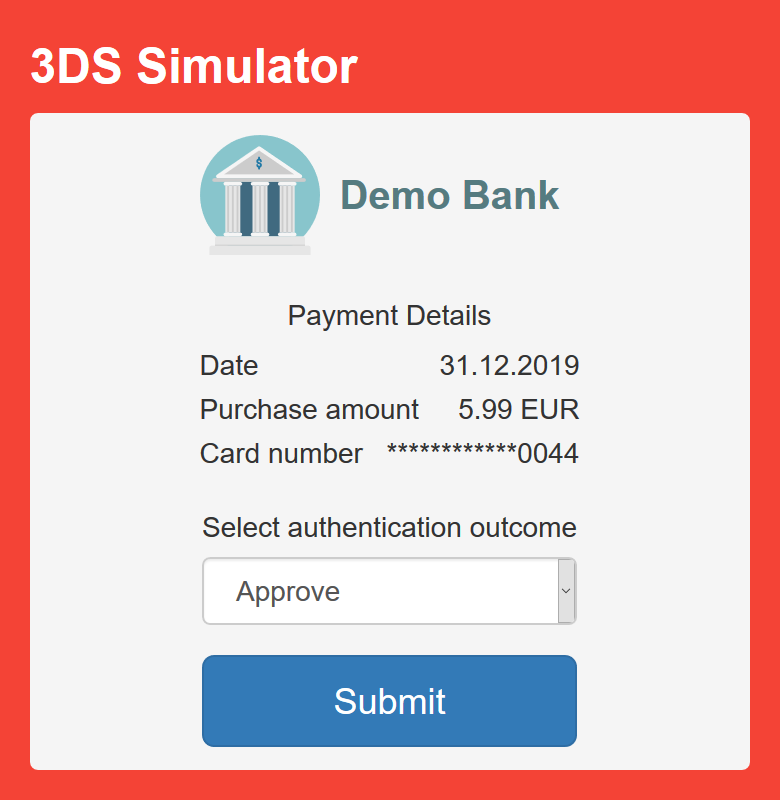

After providing one of the Test Cards (shown above) in the Payment Form a Verification Simulator will be displayed, in accordance with the 3-D Secure Version of that Test Card.

The available options are "Approve", "Decline" and "Technical Error". To Successfully Pass the 3-D Secure Verification choose "Approve".

VISA

| Card Number | Payment | Registration |

|---|---|---|

| 4440000009900010 | Challenge | Challenge |

| 4440000042200014 | Frictionless | Frictionless |

| 4440000042200022 | Authentication Attempted | n/a |

Mastercard

| Card Number | Payment | Registration |

|---|---|---|

| 5123450000000008 | Challenge | Challenge |

| 2223000000000007 | Challenge | Challenge |

| 5123456789012346 | Frictionless | n/a |

| 5555555555000018 | Frictionless | n/a |

| 5500005555555559 | Authentication Attempted | n/a |

| 5506900140100503 | Authentication Rejected | n/a |

| 5455031252665454 | Error during authentication | Error during authentication |

| 5455031256265454 | Error during authentication | Error during authentication |

| 5123459999998221 | Error during authentication | Error during authentication |

During registrations (Adding a Stored Payment Option) of Credit / Debit Cards, the 3-D Secure Verification "Challenge" flow is mandatory to enhance security.

To test a Failure scenario, select error result codes from the 3-D Secure Simulator or use an amount greater than 200.

Additional Card Details

| Item | Description | Example |

|---|---|---|

| Expiry Date | Any valid Date in the future | ex. for February 2025 enter "02/25" |

| Card Holder | Any Name can be provided | ex. "John Doe" or "Hans Gruber" |

| CVV / CVC | VISA / Mastercard - 3 Digits American Express - 4 Digits | ex. "123", "505" or "999" etc. ex. "1234", "9999" and so on |

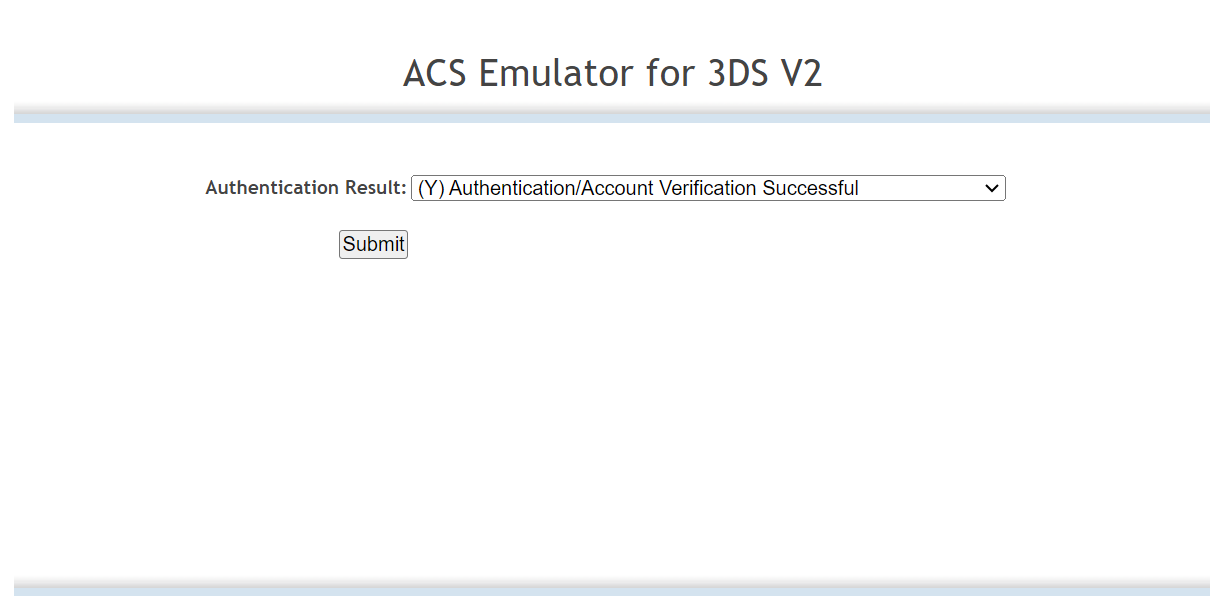

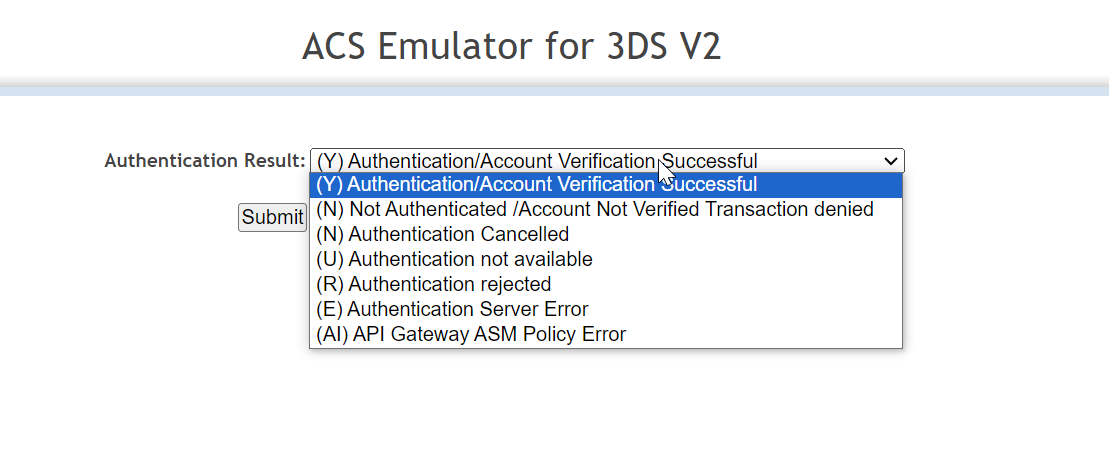

3-D Secure Verification Simulators

After providing one of the Test Cards (shown above) in the Payment Form a Verification Simulator will be displayed, in accordance with the 3-D Secure Version of that Test Card.

The available options are:

- (Y) Authentication/Account Verification Successful,

- (N) Not Authenticated/Account Not Verified Transaction Denied

- (N) Authentication Cancelled

- (U) Authentication not available

- (R) Authentication rejected

- (E) Authentication Server Error

- (AI) API Gateway ASM Policy Error

To Successfully Pass the 3-D Secure Verification choose "(Y) Authentication/Account Verification Successful".