Pay-by-Bank (Open Banking)

Introduction

Pay-by-Bank is a payment option which enables end customers to complete a payment directly from their bank account.

Pay-by-Bank payment option is based on the PIS (Payment initiation service) Open Banking standard as per PSD2 directive.

Pay-by-Bank payment option is only available for Guest Payments, i.e., it is not a storable payment option and consequently technical account payments, and MIT transactions are not possible.

Benefits of Pay-by-Bank payment option are lower fees and costs (no card scheme fees), no chargebacks, merchants can accept large payments (up to the account limit of the end customer and up to the limit of the payment rail used – e.g., FPS in UK has maximum a limit of 1 million GBP) at lower cost than card payments, improved security (all transactions need to be confirmed via SCA strong customer authentication process), faster settlement of transactions as payments are made directly between banks, etc.

Pay-by-Bank payment option is available via our SmartPay integration. For more details, please contact your Product Solution Specialist.

How Pay-by-Bank works

Pay-by-Bank works in the following way:

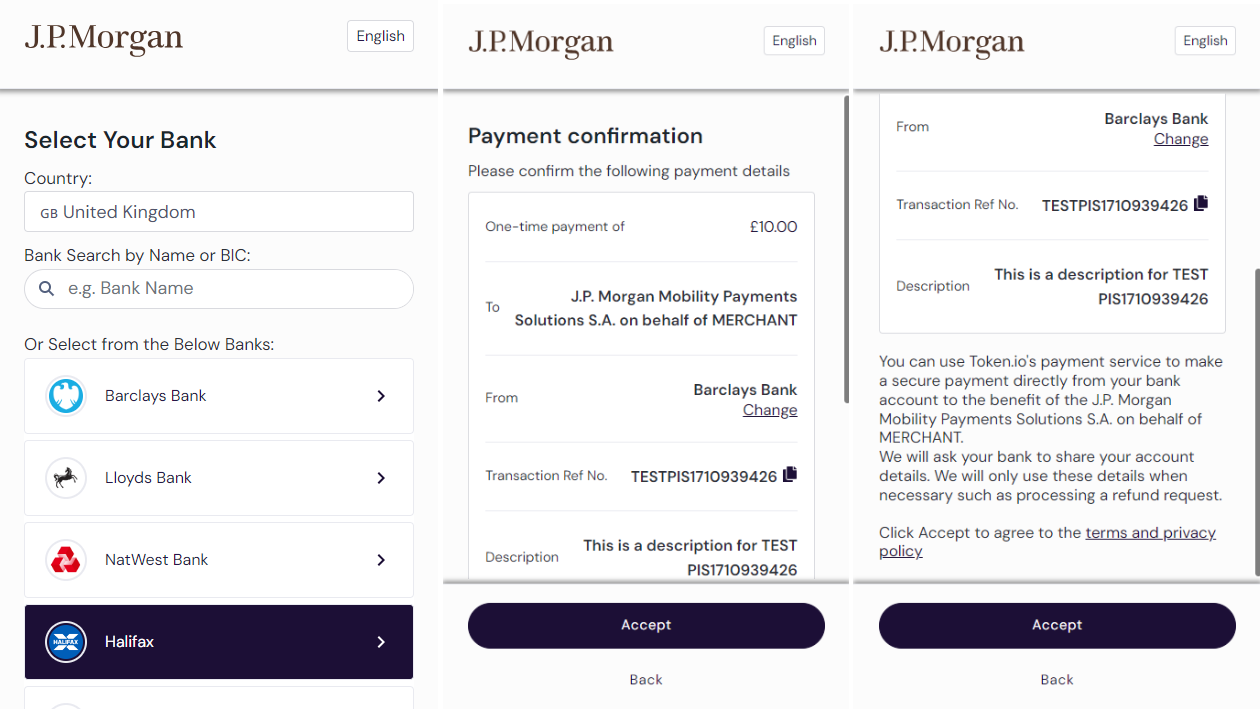

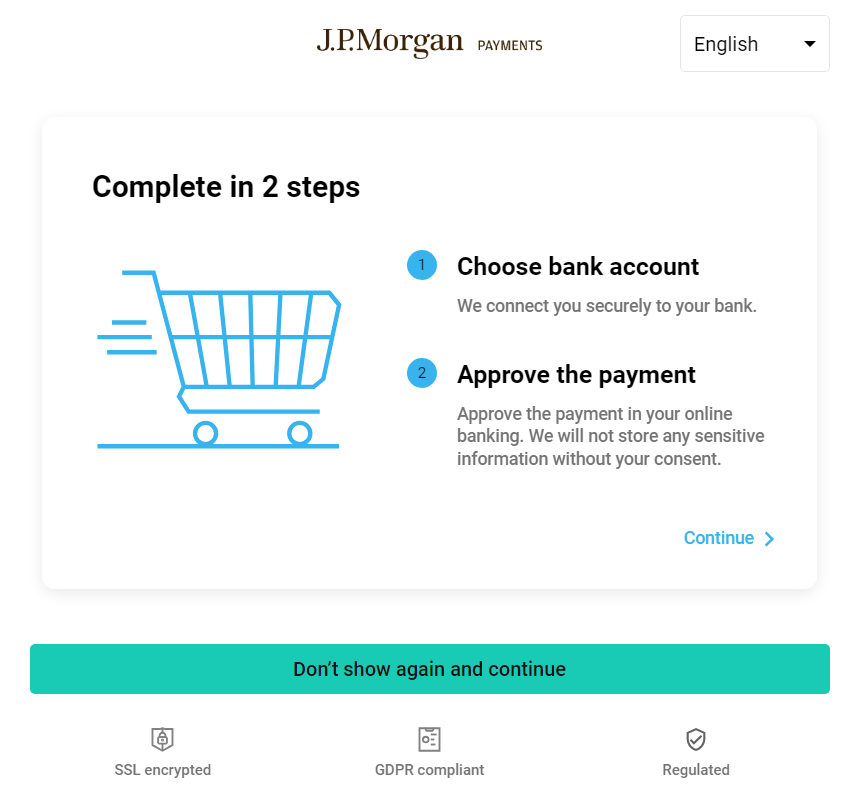

- Once the customer selects the Pay-by-Bank payment option on the SmartPay widget and confirms the payment, they are redirected to the Hosted Payment Page (HPP) i.e., to the bank selection and payment summary screen.

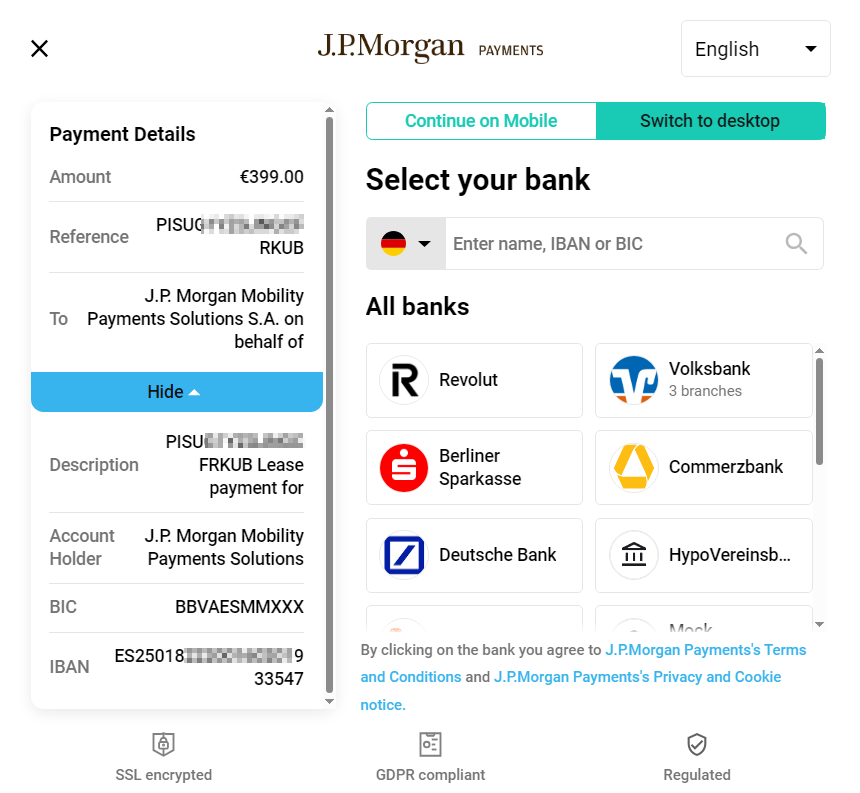

- The customer selects their bank, reviews payment details and accepts terms and conditions.

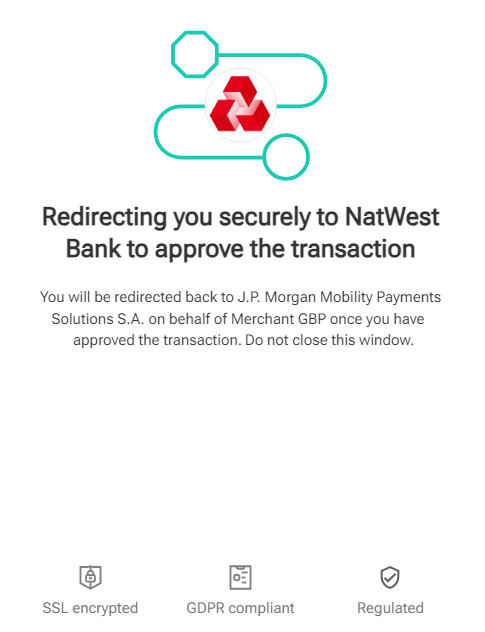

- Once confirmed, the customer is redirected to their online bank where they need to enter their online banking credentials and authorize the payment.

- The bank validates provided credentials and authorizes the payment. SCA (Strong customer authentication) is required by the banks as an additional verification of the customer. SCA process is controlled by the customer's bank and is usually an additional security factor which can be fingerprint, face recognition, one time password etc.

- Once the process with the customer's bank is completed, the customer is returned to the merchant's landing page with the information that the payment has been received and is being processed/was successfully processed.

There are two versions of the Hosted Payment Pages, V1 and V2, each offering distinct features and customization options to suit different integration requirements.

Hosted Payment Page V1��

Hosted Payment Page V2

Supported markets and currencies

Payment rails

Payment rails supported by Pay-by-Bank solution are as follows:

- FPS (Faster Payments - GBP) – UK only

- SEPA (EUR) – Eurozone markets (e.g., Germany, France, Spain)

For more information on Pay-by-Bank payment option availability i.e., markets and currencies which are supported for this payment option, please reach out to your Product Solution Specialist.

SmartPay Integration flow

Pay-by-Bank payment option is implemented via the asynchronous flow which would mean that once the customer confirms the payment via their online banking, they are returned to the merchant's landing page with a clear message from the merchant to the customer (see example in chapter "Communication with the customer") and the payment processing with their bank will continue in the background. Average processing time of successful transactions is about 90 seconds.

SmartPay integration flow for merchants

Pre-requisites for using Pay-by-Bank:

- Follow the process flow for guest payments as described in SmartPay Integration Journey.

- Implement SmartPay notifications to get transactions status updates as described in SmartPay Notifications.

- Once a notification is received, merchant needs to call Get Payment status API to check the transaction status.

Transaction status flow for successful payments

- Authorization_initialized – once the create checkout API is called, this is the initial transaction status in which the transaction will remain until a webhook notification with the outcome of the authorization is received.

- Authorization_completed – once this status is returned by SmartPay, merchant should call Capture API. For merchants using Auto-capture feature, SmartPay Capture will be automatically triggered.

- Capture_in_progress – after Capture API is triggered the transaction is moved to Capture in progress status. Once the capture is completed SmartPay will send a webhook notification with the transaction status update. Merchant needs to call Get Payment Status API to check that the transaction status was moved to Captured.

- Captured – means that the Pay-by-Bank transaction was successfully processed.

- Settled - the funds are settled to the merchant account and ready for payout according to your respective payout schedule.

Please follow the SmartPay integration documentation to integrate Pay-by-Bank as a payment option on your website.

Recommendation for merchants: it is recommended to send goods/services to customers only when the transaction is settled i.e., the payment status returned via Get Payment Status API is "Settled" as only for Settled transactions it is 100% guaranteed that money for the order has reached the e-money merchant account.

Communication with the customer

As Pay-by-Bank is an asynchronous payment method i.e., it can take additional time to get the confirmation from customer's banks (after payment completion by the customer), so it is important that merchant communication towards the customer is correct and precise to avoid unnecessary customer inquiries and complaints while waiting for the payment to get confirmed.

Example of communication to customers after Pay-by-Bank transaction completion:

Your payment has been submitted. Once the processing with your bank is completed, we will notify you of the outcome and your account will be charged accordingly.

Final information after payment processing is done, can be communicated to the customer by a merchant via email or updating the status of customer's account in merchant portal etc.